In one of the earlier posts, I explained the Core-Satellite strategy, in which you split your portfolio between a Core, focused on worldwide ETFs with maximum diversification, and Satellites, focused on specific bets you believe will pay off in the long term (e.g. sector or themed bets).

When I first read about it, I thought it made perfect sense and so I have adopted it for my investments.

Then, recently I watched this video about Thematic ETFs. The primary argument of the author (Ben Felix) is that thematic ETFs are a bad investment because they are usually created at the peak of the hype for that specific theme and then are poised to go down when the hype starts to fade. He quotes several papers and bring evidence to support his thesis - I strongly recommend watching it.

As someone who has thematic ETFs and follows a Core-Satellite strategy, I was triggered by this and checked my personal (and anecdotal) history, starting with my biggest Thematic ETF - iShares Global Clean Energy UCITS ETF USD (Dist). I started investing in October 2019 and this has been one of the best performing asset I have bought!

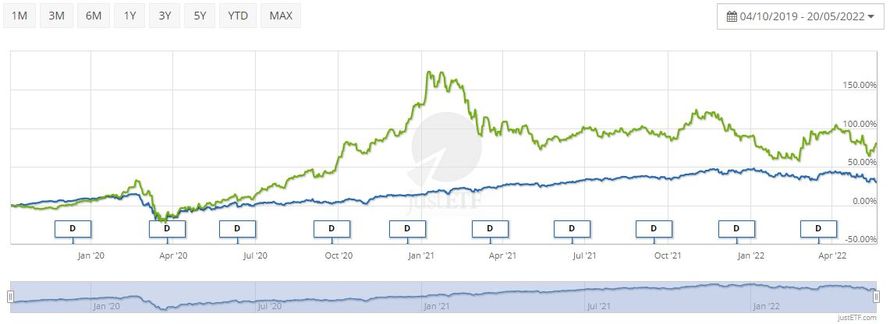

Below you can see the comparison of Global Clean Energy (in green) and Vanguard FTSE All-World UCITS ETF Distributing (in blue).

Considering this specific timeframe, I am better off with Global Clean Energy ETF, even considering the higher TER of the former.

However, the point in the video is that Thematic ETFs are usually overvalued at the time of inception, so what happens if we go back in time until the Global Clean Energy ETF was created?

Well...the picture changes quite dramatically. If you invested in the ETF on the first day of trading and you kept it faithfully until today, you would have lost more than 33% of your (nominal) value in 15 years.

By comparison, if you invested in iShares MSCI World UCITS ETF (Dist) from the same date, you would have gained 174% on your money (the previous ETF did not have such a long history and so could not be used).

I must say this was a bit of a eye opener for me. I will for sure still keep an eye on Thematic ETFs, but will be a bit more careful about them. For example, I will be checking the inception date and (it goes without saying) the past trend. Last but not least, also a quick search on Google trends might be worth your time to understand the "hype" (or amount of searches) on related keywords.

Write a comment