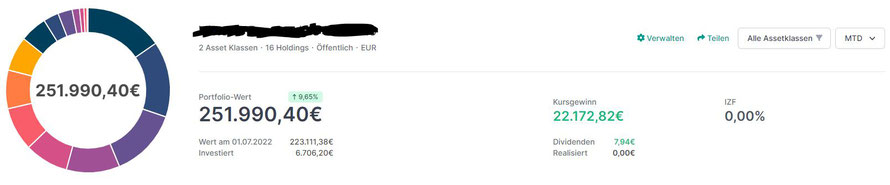

What an unexpected rebound the month of July brought! It is the first time since March that the month ends on a plus.

And what a plus! With a gain of more than 22,000 Euro ITM, the losses of both June and May are recovered. Does it change anything for the long term? Actually no - so while it is nice, there is no particular reason to celebrate.

In July, I kept my investments on track and followed the usual Dollar Cost Averaging strategy:

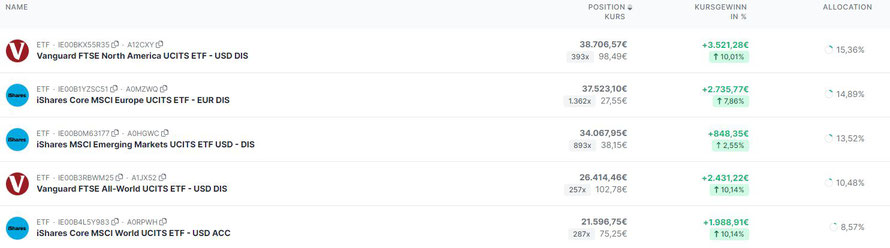

- I bought the usual iShares Core MSCI Europe ETF for 2,700 Euro - one of the 3 geographical ETFs that i keep investing in

- I bought Vanguard FTSE All-World ACC ETF for 4,000 Euro rather than paying back the mortgage (if you have a low fixed interest rate for the next few years and you have the possibility to pay back more of the capital, I would recommend not doing so but to reinvest that money)

Everything pretty much bounced back in July if I look at the top 5 ETFs - the Emerging Market one not as much as the others though.

July is not a great month for dividends and in fact in the whole period only Nike paid out a meager 7.94 Euro. The year to date count now reaches almost 2,000 Euro!

Write a comment

Projector (Friday, 05 August 2022 12:54)

I just want to thank you for all the updates and your analysis! Its really helpful and much appreciated!

just(an)ordinaryguy (Saturday, 06 August 2022 09:01)

Thank you very much!