2022 is finally behind us and I dont think many investors will miss it :-p

It was a rollercoaster of a year, mostly in the red except for a few days in April and August when the market rallied. While seeing my portfolio value getting again so close to the invested amount was scary at times, it never really bothered me too much, as I have still a few years before I can reach financial independence.

My thoughts are with those who "fired" at the beginning of the year, and probably lost high single digits percentages of their portfolio - that must not be easy and probably require some intervenction (see sequence of risk).

Before looking at the full year, let´s see December - I had to limit the amount invested to beef up the saving account and to consider the usual extra expenses for the period, therefore have only invested 1,500 Euro in iShares Emerging Markets USD. December was quite abysmal as month as you can see below.

I have done the budget for 2023 (subject of another upcoming blog post) and I think I will be lucky if I can keep this monthly investmant for next year, mostly due to higher cost and probably a lower salary.

With 420 Euro the dividend income was not bad and represents a 46% increase year on year in the month. Top contributors are Invesco S&P 500 High Dividend Low Volatility (191 Euro), Vanguard FTSE North America (130 Euro) and Vanguard FTSE All-World (91 Euro). I will mention the totals for the year in the summary section below.

Now, looking back at the full year, you can see below the rollercoaster effect mentioned earlier in the post.

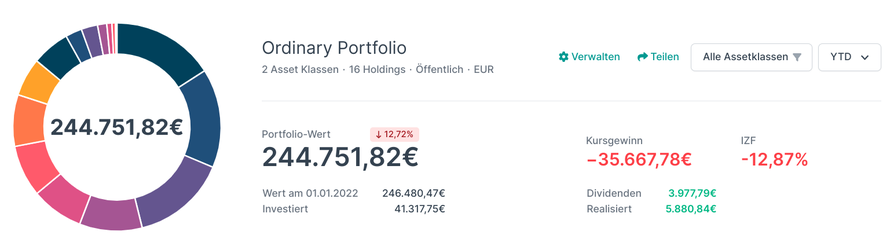

In terms of total picture, I reached a portfolio value of almost 245.000 Euro in 2022 and this includes almost 36,000 Euro of lost potential. The difference between my portfolio value and invested value was narrowed to just 5,000 Euro on December 31st, 2022. I did some minor operations so I have a positive realized gain of 5,881 Euro but that does not change the overall picture (and the long term strategy).

The total dividends received were almost 4,000 Euro in 2022, which I consider a good amount. I dont really chase dividends and in fact the dividend yield is just 1.6% (take the dividends received and divide them by the portfolio value) but I like to see the growth in this area (+118% year on year, so 2022 vs 2021).

Let´s see what 2023 brings. My objective is to keep investing as much as I can now that the market is down, but I need to balance that with everything else.

Stay tuned for more and best wishes to you all for 2023!

Write a comment