If you read the monthly updates of the portfolio you might think that I have everything in order and that my portfolio has just a limited set of ETFs (the three geographical ones). Unfortunately the truth is quite different and I am still burdened by a lot of (potentially wrong) choices I did in the past. Today, I will expose all of them, with the hope you will not repeat some of the mistakes.

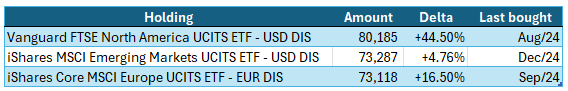

The Running ones

These are the ETFs I buy regularly and try to keep balanced in equal parts. No change foreseen in the future!

The ones for specific pots of money

These ETFs allow me to keep certain money separate from everything else. For example, I am using the first one for money I could use to pay back the mortgage. Right now I have a very low interest rate on the mortgage and at a certain point will use this money to pay back some capital in advance. If I were to invest it in the other ETFs, I would have difficulties calculating back how much it would be.

If it wasnt for the need to keep this money separate, I would have bought the running ETFs instead.

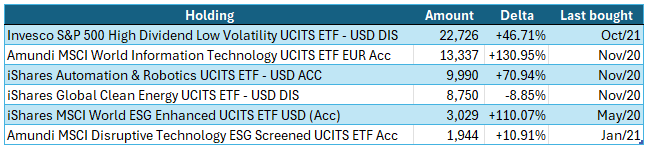

Thematic ETFs

I was quite keen on Thematic ETFs at a certain point but as you can see from the dates in the last column, I stopped pursuing this strategy a few years ago. After reading more on the topic (and writing on it here), I decided to stop. One could argue that I should have also sold in the meantime, but I never got to it.

The Clean Energy one is the most painful - at its peak I was 124% above the original investment and now it is in the red.

Maybe one of the resolutions for 2025 should be to clean the house a bit.

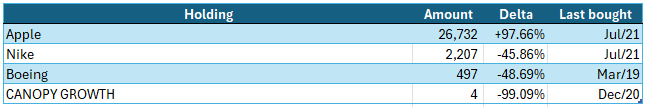

Cherry Picking

Everyone falls for the idea of beating the market and I was no exception to it. It worked out pretty bad as you can see above.

Canopy Growth is a company selling medical marijuana and I bought it after my wife could not stop talking about it when she heard the story from a colleague. Worst investment ever made, I keep it to remind myself of these situations for the future.

Boeing is quite a shameful experiment. After the tragedy of the 777 Max crashes I thought Boeing would regress back to the mean, so I bought the stock. Of course, Corona arrived later and the company turned out to be a shell of what it used to be. I learnt never to invest on the tragedies of others and will keep holding this as a reminder.

So, here you have it, the full portfolio - including all mistakes that I carry along with me. Some I dont want to correct because they act as reminder of somethings, others I dont correct just for pure laziness.

Nobody is perfect I guess :-p

Write a comment

Claudia (Thursday, 13 February 2025 16:50)

Thanks for mentioning me on your blog �